Freelancing has become a popular career choice in the Philippines, offering flexibility and the chance to work on diverse projects. Whether you’re a seasoned freelancer or just starting out, understanding the landscape can help you navigate this dynamic field. Here’s an overview of freelancing in the Philippines, career options, BIR registration and its advantages over regular sole proprietor registration.

Why Freelancing?

Freelancing offers several advantages:

- Flexibility: Work from anywhere and set your own schedule.

- Diverse Opportunities: Engage in various projects across different industries.

- Control Over Earnings: Potential to earn more by taking on multiple clients or high-paying projects.

Freelancing Career Options

Freelancers in the Philippines work in a wide range of fields, including:

- Writing and Content Creation: Bloggers, copywriters, and content strategists.

- Graphic Design: Logo design, branding, and digital illustrations.

- Web Development and Programming: Building websites, apps, and software solutions.

- Digital Marketing: Social media management, SEO, and online advertising.

- Virtual Assistance: Administrative support, customer service, and data entry.

How to Register in BIR as a Freelancer

To ensure you’re compliant with local tax laws, it’s essential to register with the Bureau of Internal Revenue (BIR). Here’s a step-by-step guide to help you through the process in 2024.

Step 1: Prepare the Necessary Documents

Before heading to the BIR office, make sure you have the following documents ready:

- Valid ID: Government-issued ID (e.g., passport, driver’s license).

- Proof of Address: Barangay Clearance, House Title, or Authorization for Occupancy (if House Title is not under the taxpayer’s name)

- Professional Tax Receipt (PTR): Professional Tax Receipt if with PRC ID or Occupational Tax Receipt for other profession)

- Tax Identification Number (TIN): If you already have one. If not, you can apply for it during the registration process.

Step 2: Visit the BIR Office

Go to the BIR Revenue District Office (RDO) that has jurisdiction over your place of residence. You can find the nearest RDO on the BIR website.

Step 3: Fill Out the BIR Form 1901

Application for Registration for Self-Employed and Mixed Income Individuals, Estates, and Trusts.

Step 4: Submit the Documents

Submit the completed forms along with the required documents and the payment receipt to the BIR officer. They will process your application and issue Form 2303 or Certificate of Registration (COR).

Step 5: Know your BIR Filings and Compliance

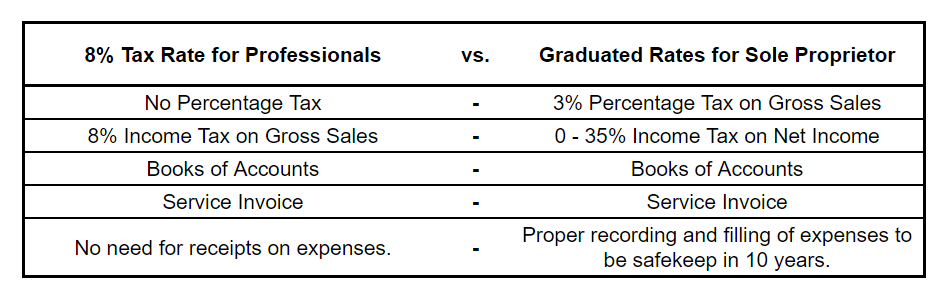

- Annual Income Tax: This is form 1701, which are filed every April 15 following the end of the taxable year under the special 8% Gross Receipts tax rate)

- Quarterly Income Tax: This is form 1701Q, which are filed every quarter 60 days from the end of the taxable quarter under the special 8% Gross Receipts tax rate)

- Books of Accounts: Official books registered with BIR for the recording of business transactions)

- Authority to Print or ATP: This is a permit issued by the Bureau of Internal Revenue (BIR) that allows businesses to print official receipts, sales invoices, and other commercial documents.

- Service Invoice: This document is issued by service providers to their clients to detail the services rendered and the corresponding charges. It serves as an official record of the transaction.

Step 6: Keep Your Records

Once registered, make sure to keep all your receipts, invoices, and other financial documents organized up to 10 years. This will help you when it’s time to file your taxes and ensure you remain compliant with BIR regulations.

Advantages of Registering as a Freelancer

Registering in BIR as a freelancer offers several advantages compared to registering as a regular sole proprietor. Here are some key benefits:

1. Simplified Tax Compliance:

2. Professional Credibility:

- Registering as a freelancer enhances your professional credibility. Clients are more likely to trust and engage with freelancers who can issue official receipts and are compliant with tax regulations.

- It demonstrates professionalism and commitment to legal standards, which can attract more clients.

3. Access to Government Services:

- Being registered allows freelancers to access various government services and benefits, such as social security and healthcare.

- It also facilitates participation in government procurement programs and contracts.

4. Avoiding Penalties:

- Proper registration helps avoid penalties, fines, and legal repercussions associated with tax evasion.

- Timely tax payments and compliance can save money in the long run by avoiding interest and surcharges.

5. Flexibility in Income Reporting:

- Freelancers can report income more flexibly, especially if they have multiple sources of income from different clients.

- This flexibility can be beneficial for managing finances and tax obligations more effectively.

Freelancing in the Philippines has helped a lot of the working force during and even after the pandemic. It offers a flexible working schedule and work from home setup that benefits most of the employees that are burdened by daily commute to their workplace. However, this setup comes with the responsibility of registering with the BIR to legitimize their business and ensure compliance with tax laws. This crucial step can be quite tedious for those who don’t have the time to line up to different government offices, fill up, and file documents. This is where Account It Right can help. We can take all these tasks off your shoulders so you can focus more on catering to your clients’ needs. Just hit the button below to send us an inquiry.

Sources: The EarnCredibles | Grit PH | Juan Remote Work